LAND REVENUE SYSTEM IN BRITISH INDIA

Land revenue policy under British East India Company. Since the acquisition of Diwani rights for Bengal, Bihar and Orissa in 1765, a major concern of Company was to increase the land revenue collection, which historically was the major source of revenue for the state in India. Warren Hastings got rid of Indians completely form revenue collection. In 1772, he introduced a new system known as the ‘farming system’, in which European district collectors were made in charge of revenue collection. Land was farmed to the highest bidder for five years. Most of the revenue-farmers were speculators who did not have any permanent interest in the land and tried to extort maximum revenue from the cultivators. The result was that many revenue contractors fell in heavy arrears, many had to be arrested for default and the ryot (farmer) deserted the land. The bias of Warrant Hastings against centralization worked against an effective system of land revenue collection. Permanent Settlement system.

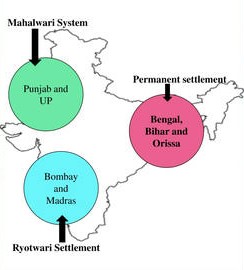

• Features of the British land-revenue policy PERMANENT SETTLEMENT:-----It was introduced in Bengal, Bihar, Orissa, Banaras division of modern UP, and Northern Carnatic in the 18th century.

The zamindars were recognised as the owners of land and a ten years’ settlement was made with them in 1790. In 1793, under Governor General Lord Cornwallis the decennial settlement was declared permanent and the zamindars and their legitimate successors were allowed to hold their estates at that very assessed rate for ever. The state demand was fixed at 89% of rental.

•British land revenue system, Reasons for the introduction of Permanent Settlement system:-----This ensured a fixed and stable income for Company. It also saved the government from the expensed on making periodical assessments and settlements.

•classification of British land-revenue policy

•classification.

•British land revenue system, Reasons for the introduction of Permanent Settlement system:-----This ensured a fixed and stable income for Company. It also saved the government from the expensed on making periodical assessments and settlements.

•A permanent settlement, it was hoped would end corruption as the officials would not be able to alter assessment at will.

• The burden of revenue collection was given to the intermediaries or Zamindars. This eased the burden of administration on the part of Company.

•It was thought at that time, that a revenue demand which was fixed, would lead to

investments in agriculture on the part of the Zamindars as the increase in revenue

would benefit them.Cornwallis thought that the company could increase its revenue by

• A loyal group was created whose interests were in the continuation of British rule in

India.

=====Consequences of British land-revenue policy:------ a great loser in the long run as prospective share in the increase in land revenue were sacrificed.

• Since the land revenue was to be fixed for perpetuity, it was fixed at a high level – the

absolute maximum, and the customary rates were increased. This placed a high burden of revenue.

•Distribution on map

• Though a fixed revenue demand was placed with the Zamindars, no rules were placed regulating the collection of revenue from the peasants. As a result, Zamindars placed exorbitant demands.

• Absentee landlordism was a consequential feature. Zamindars took no interest in the

development of agriculture.

•Peasants suffered from the double injustice of surrendering their property rights and being left entirely at the mercy of Zamindars. Ryotwari System.This system was first introduced in Malabar, Coimbatore, Madras and, Madurai by Sir Thomas Munro. Subsequently, this system was extended to Maharashtra, East Bengal, parts of Assam and Coorg.

• Main reasons behind its adoption British land-revenue policy RYOTWARI were:---1. In permanent settlement areas, land Revenue was fixed. Over the years, agriculture prices/exports increased but government’s income did not increase. (Because middlemen-zamindars pocketed the surplus)

2. Zamindars were oppressive which resulted in frequent agrarian revolts in the

permanent settlement areas.

3. In Bihar, Bengal, there existed Zamindar/feudal lords since the times of Mughal administration. But Madras, Bombay, Assam did not have/ Zamindarsl feudal lords with large estates. So, it was hard to ‘outsource’ work, even if British wanted.

4. In case of Ryotwari there is no middlemen for tax collection thus farmer has to pay less

taxes which increased their purchasing power that resulted in increased demand for readymade British products in India.

Consequently, all subsequent land tax or revenue settlements made by the colonial rulers were temporary settlements made directly with the peasant, or ‘ryot’ (e.g., the ryotwari settlements).This model was based on English yeomen farmers.

•Features of the British land-revenue policy:-----1. Government claimed the property rights to all the land, but allotted it to the cultivators on the condition that they pay taxes. In other words, it established a direct relation between the landholder and the government.

2. Farmers could use, sell, mortgage, bequeath, and lease the land as long as they paid their taxes. In other words Ryotwari system gave a proprietary right to the landholders.

3. If they did not pay taxes, they were evicted.

4. Taxes were only fixed in a temporary settlement for a period of thirty years and then revised.

5. Government had retained the right to enhance land revenue whenever it wanted.

6. Provided measures for revenue relief during famines but they were seldom applied in real life situation.

•CONSEQUENCES of the British land-revenue policy :(RYOTWARI)------. Farmers had to pay revenue even during drought and famines, else he would be evicted.

2. It amounted to replacement of large number of zamindars by one giant zamindar called East India Company.

3. Although ryotwari system aimed for direct Revenue settlement between farmer and The government but over the years, landlordism and tenancy became widespread. Because textile weavers were unemployed so they started working as tenant farmers For other rich farmers. In many districts, more than 2/3 of farmland was leased.

4. Since Government insisted on cash revenue, farmers resorted to growing cash crops instead of food crops. And cash crop needed more inputs which resulted in more loans and indebtedness.

5. After end of American civil war, cotton export declined but government didn’t reduce the revenue. As a result most farmers defaulted on loans and land was transferred from farmers to moneylenders.

•MAHALWARI system of British land-revenue(click on to know more details)

• Main reasons behind its adoption British land-revenue policy RYOTWARI were:---1. In permanent settlement areas, land Revenue was fixed. Over the years, agriculture prices/exports increased but government’s income did not increase. (Because middlemen-zamindars pocketed the surplus)

2. Zamindars were oppressive which resulted in frequent agrarian revolts in the

permanent settlement areas.

3. In Bihar, Bengal, there existed Zamindar/feudal lords since the times of Mughal administration. But Madras, Bombay, Assam did not have/ Zamindarsl feudal lords with large estates. So, it was hard to ‘outsource’ work, even if British wanted.

4. In case of Ryotwari there is no middlemen for tax collection thus farmer has to pay less

taxes which increased their purchasing power that resulted in increased demand for readymade British products in India.

Consequently, all subsequent land tax or revenue settlements made by the colonial rulers were temporary settlements made directly with the peasant, or ‘ryot’ (e.g., the ryotwari settlements).This model was based on English yeomen farmers.

•Features of the British land-revenue policy:-----1. Government claimed the property rights to all the land, but allotted it to the cultivators on the condition that they pay taxes. In other words, it established a direct relation between the landholder and the government.

2. Farmers could use, sell, mortgage, bequeath, and lease the land as long as they paid their taxes. In other words Ryotwari system gave a proprietary right to the landholders.

3. If they did not pay taxes, they were evicted.

4. Taxes were only fixed in a temporary settlement for a period of thirty years and then revised.

5. Government had retained the right to enhance land revenue whenever it wanted.

6. Provided measures for revenue relief during famines but they were seldom applied in real life situation.

•CONSEQUENCES of the British land-revenue policy :(RYOTWARI)------. Farmers had to pay revenue even during drought and famines, else he would be evicted.

2. It amounted to replacement of large number of zamindars by one giant zamindar called East India Company.

3. Although ryotwari system aimed for direct Revenue settlement between farmer and The government but over the years, landlordism and tenancy became widespread. Because textile weavers were unemployed so they started working as tenant farmers For other rich farmers. In many districts, more than 2/3 of farmland was leased.

4. Since Government insisted on cash revenue, farmers resorted to growing cash crops instead of food crops. And cash crop needed more inputs which resulted in more loans and indebtedness.

5. After end of American civil war, cotton export declined but government didn’t reduce the revenue. As a result most farmers defaulted on loans and land was transferred from farmers to moneylenders.

•MAHALWARI system of British land-revenue(click on to know more details)

Shram Yogi Mandhan Yojana | Pradhan Mantri Shram Yogi Mandhan

ReplyDelete